how much is inheritance tax in oklahoma

As a result if a persons estate is less than 5490000 and there are no other. Here is an example.

Oklahoma Estate Tax Everything You Need To Know Smartasset

No estate tax or inheritance tax.

. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. For all individuals not in classes A or B the. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520.

Then you will pay rates ranging from 4 on inheritances worth up to 10000 and 16 on anything worth 200000 or more. The 2018 Tax Reform Act. Above that amount anything you leave behind might be subject to 40 tax.

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer How Do State Estate And Inheritance Taxes Work Tax Policy Center Pin On Parks Educational Campaign. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. Your average tax rate is.

Consult a certified tax professional with any tax-related questions Oklahoma. If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real. 6 rows State inheritance tax rates range from 1 up to 16.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. Your average tax rate is 1198 and your. Oklahoma collects income taxes from its residents at the following rates.

The top estate tax rate is 16 percent exemption threshold. There is no federal. Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a.

Inheritance tax usually applies when a. Oklahoma does not have an inheritance tax. The current amount that requires federal taxes is any inheritance equal to or greater than 5490000.

The statewide sales tax in Oklahoma is 450. This helped provide clarity for Oklahoma estate planning. No estate tax or inheritance tax.

Lets cut right to the chase. A few states have disclosed exemption limits for. State inheritance tax rates range from 1 up to 16.

The statewide sales tax in Oklahoma is 450. Federal Estate Tax Now the IRS Estate Tax Exemption and IRS Gift Tax Exclusion are updated annually. Oklahoma Income Tax Calculator 2021.

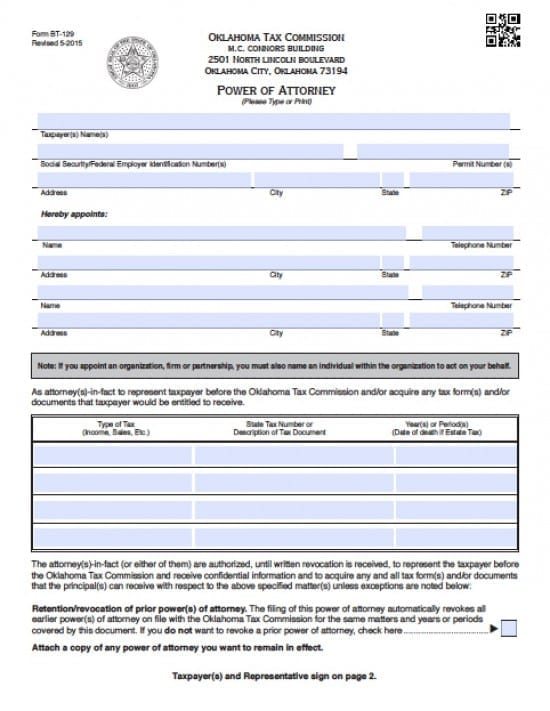

Free Oklahoma Tax Power Of Attorney Form Bt 129 Pdf Eforms

A Better Path Forward A Budget And Tax Roadmap For Oklahoma Oklahoma Policy Institute

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

State Estate And Inheritance Taxes In 2014 Tax Foundation

States With No Estate Or Inheritance Taxes

Estate And Inheritance Taxes In Oklahoma Tax Strategies Planning

Estate Planning Tulsa Tax Preparation Oklahoma Ok

Do I Need To Pay Inheritance Taxes Postic Bates P C

![]()

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Do I Need To Pay Inheritance Taxes Postic Bates P C

Oklahoma Inheritance Laws What You Should Know Smartasset

Is Probate Needed Oklahoma Bar Association

Free Report What Is The Annual Gift Tax Exclusion In Oklahoma

Oklahoma Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Complete And E File 2021 2022 Oklahoma Income State Taxes

Federal Estate Tax Exemption 2021 Cortes Law Firm

Oklahoma Probate Law Q A Part 3 Gary Crews Tulsa Probate Attorney